M News: What's New With Us. What Matters To You.

Finding A Way To Go Your Own Way With The Right Small Business Loan

August 24, 2017 8:34 pmEveryone loves your homemade BBQ sauce, and you’ve started to wonder if you could actually create a business out of it. You learn about your potential market, create a business plan, develop your brand, work out the costs, find a location, and then what? More than likely you’re going to need a small business loan.

There’s no better place than to look to your local community bank. Community banks like Merchants Bank of Alabama, a division of SouthPoint Bank, tend to focus on the needs of the businesses and families where the bank holds branches and offices. They are also typically locally owned and operated meaning they know you, your family and how your business idea will fit into the local economy. And, perhaps the main benefit is that lending decisions are made by people who understand the local needs of families, businesses and farmers.

Two years ago, when we launched our new website, we set out to develop tools that would help our local small business customers. How are we different? What sets us apart? We knew that our local lenders connected us to our communities in very powerful ways that big banks can’t touch. That’s why we created a section on our site called Lender Connect. Here you can meet our local lenders and easily connect with them via phone or email. You can also get to know these local lenders by reading their bios. You’ll quickly see that the majority of them not only live here, but were born and raised here.

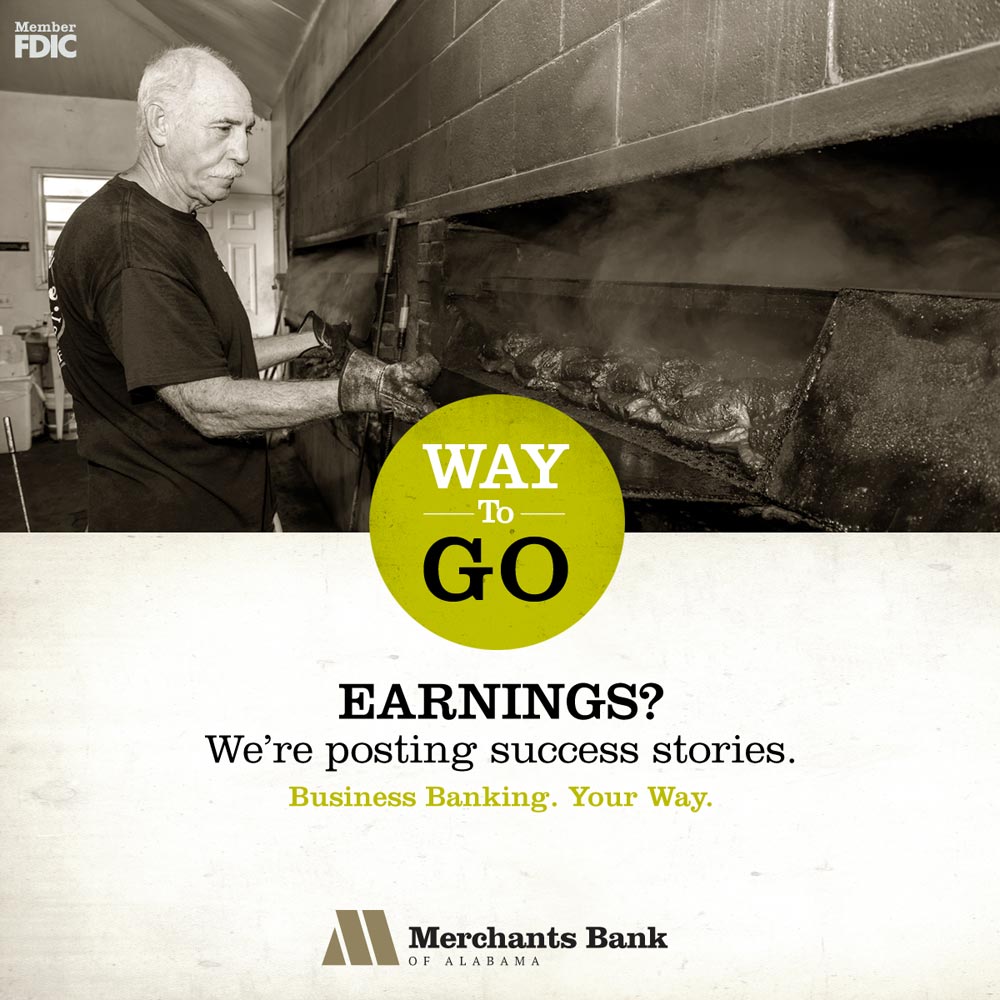

Merchants has developed real partnerships with local businesses and you can read about some of our local business success stories in the Way To Go section of our web site. Eight very different local small businesses with one thing in common. A bank with an uncommon commitment to our local small business customers. Read the stories and you’ll get the inside scoop on how we helped these remarkable business owners in Cullman, Hanceville, Fairview and Arab go from having a big dream to having a big following. Because community banks are themselves small businesses, they understand the needs of small business owners. Their core concern is lending to small businesses and farms and they make over half of all small business loans.

Get to know the local businesses near you. No matter what their product or service, their focus is delivering the best in customer service, just like their local bank does. From local restaurants and volunteer fire departments to a variety of retail establishments, we set out to build real relationships with our business customers.

Small business loans are available from a large number of traditional and alternative lenders. Small business loans can help your business grow, expand into new territories, enhance sales and marketing efforts, allow you to hire new people, and much more.

So, if you need to secure your first small business loan or to expand a current business, we invite you to start with your local community bank. Reach out to the lender nearest you, preferably via our Lender Connect portal. To give you even more information, we are sharing an article from a recent issue of Forbes, “10 Key Steps To Getting A Small Business Loan”. By anticipating what lenders will review and require, you will greatly increase your chances of obtaining a beneficial small business loan.

Read the full article at forbes.com.

Behind Every Successful Small Business You’ll Find A Local Bank

June 20, 2017 1:14 pmWe’re a small business friendly bank and have been since 1907. Community banks make over half of small business loans employing 2 out of 3 people. Because community banks are themselves small businesses and are local, they understand the needs of small business owners especially when it comes to small business lending and way better business banking. Their core concern is lending to small businesses and farms. The core concern of the mega banks is corporate America. We have added three small business success stories featuring our small business customers: Top Hat Barbecue, Van’s Sporting Goods and Werner’s Trading Company. Read about why Merchants Bank of Alabama, a division of SouthPoint Bank, is their small business bank of choice.

Read our latest Business Success Stories here >

Our New Construction Loans Mean You Can Keep Things Building, Especially The Excitement.

June 22, 2016 1:44 pmIs a new house on your bucket list? Get the new construction loan packed with advantages such as upfront approvals for both the construction loan and your permanent mortgage at the same time. And if Merchants finances both loans (construction and perm), then we only charge you closing costs once. We also don’t limit the amount or frequency of your construction draws, giving you greater flexibility and peace of mind. And throughout the homebuilding process, your Merchants lender offers critical service and support to help you through one of the most exciting times of your life.

When you are ready to build, the last thing you need is watered down banking. Build, remodel or buy with a bank that treats you like a big fish. And makes your dream a big priority. Call Michelle Kimbrough at 256-735-2505 or Wanda Folds at 256-735-2994 today.

The Way We Are Making Mobile Banking Even Better

June 11, 2015 10:41 pmNow you can complete bank transactions including depositing a check at the soccer field, in the carpool line, even in line at the grocery store. While life sometimes keeps you waiting, your bank never will.

With the new Mobile Deposit feature, you save time by eliminating a trip to the bank to deposit a check. Whenever you have a check in your hand, simply use the Merchants Mobile App and take a photo of your check with your smart phone to make the deposit.

Life in our communities is faster paced than ever, so being a great community bank means keeping step with the latest and best technology. With Merchants Mobile, you get full service banking by pulling your smart phone out of your pocket, not taking time out of your day.

FACEBOOK

FACEBOOK